For many Australian families, the first conversation about aged care is also the first time they realise how the fees and costs are structured. Asking “How much will it cost?” can quickly turn into a maze of unfamiliar terms, government formulas, and financial trade-offs. It is not uncommon for adult children to feel overwhelmed while trying to support a parent, or for older Australians to feel anxious about what their life savings may need to fund.

Aged care fees are not just a single weekly or monthly charge. They are made up of several different components, each with its own rules, calculations, and long-term implications. Some are mandatory for everyone, and others depend on income, assets, and personal choices. Understanding how these pieces fit together is the key to avoiding rushed decisions, unnecessary stress, and costly financial mistakes.

The good news is that aged care fees are regulated and structured. With clear information, they become far more manageable. Once families understand the framework, they can start making decisions with confidence rather than fear.

Before making any commitments, it is worth understanding how aged care fees really work.

Three Core Aged Care Fees You May Encounter

Under the reformed aged care framework, residential aged care costs are broadly grouped into three main areas: accommodation, everyday living expenses, and care services. While everyone contributes something, how much you pay depends on your assets, income, and the choices you make when entering care.

Accommodation costs relate to the room and facility itself and are handled separately from care. These costs are met through a Refundable Accommodation Deposit (RAD), a Daily Accommodation Payment (DAP), or a combination of both.

Everyday living expenses cover day-to-day costs such as meals, cleaning, laundry, utilities, and lifestyle services. These costs replace much of what was previously captured through the old means-tested fee system. Residents with higher levels of income or assets may contribute more toward these expenses, while lower-means residents receive greater government support.

Care services are now more clearly split. Clinical care — including medical and nursing care — is fully funded by the government. Non-clinical care, such as personal assistance and support services, may involve additional contributions for residents above certain income and asset thresholds, but these contributions are capped over a lifetime.

While the structure is more transparent, the interaction between these elements means outcomes can still vary significantly between individuals.

RADs and DAPs: Accommodation Costs in Plain English

The Refundable Accommodation Deposit, or RAD, is often the most confronting figure families see. It is usually a large lump sum and can feel like an upfront “fee”. In reality, a RAD is best understood as an interest-free loan to the aged care facility, with a catch. The full amount used to be deductible, however for new care residents from 1 November 2025, 2% per year up to 10% must be retained by the home, plus other agreed deductions.

Most RADs are funded by selling the family home or using existing savings. While the money is refundable, paying a RAD can still affect long-term wealth, estate outcomes, and Age Pension entitlements. It is not just about whether you can afford it, but about how it fits into your broader financial picture.

The Daily Accommodation Payment, or DAP, is the alternative. Instead of paying a lump sum, you pay a daily amount calculated using a government interest rate applied to the RAD value. This amount is not refundable at all, and increases with indexation each year.

Residents can choose a combination of both, paying part of the RAD upfront and the rest as a reduced DAP. This flexibility allows families to manage cash flow while still reducing long-term costs.

The decision between RAD and DAP is not simply about affordability today. It is about long-term strategy, tax implications, government subsidies, estate planning, income sustainability, and personal comfort with asset use. Understanding these trade-offs before committing is critical.

Everyday Living and Care Costs: What Has Replaced Means-Testing

One of the biggest changes under the new aged care system is the removal of the traditional means-tested care fee. Instead, daily fees are now split into clearer categories that reflect how care is delivered and funded.

Everyday living expenses cover the non-care costs of living in a residential facility. Residents with assets over approximately $238,000 or income above $95,400 (or a combination) may pay additional daily amounts toward these costs. These contributions are designed to reflect a person’s capacity to pay, while still ensuring essential services remain accessible.

Clinical care is fully funded by the government. This change removes a major source of financial uncertainty for families and ensures that medical and nursing care is provided based on need, not wealth.

Non-clinical care contributions apply to residents with higher income and asset levels. These contributions are capped, both by time (generally the first four years of care) and by a lifetime dollar limit, currently indexed to $130,000. Importantly, this lifetime cap applies across both residential and home care, providing certainty about maximum long-term exposure.

While this new structure is simpler in concept, the calculations and thresholds mean that professional advice can still significantly influence outcomes.

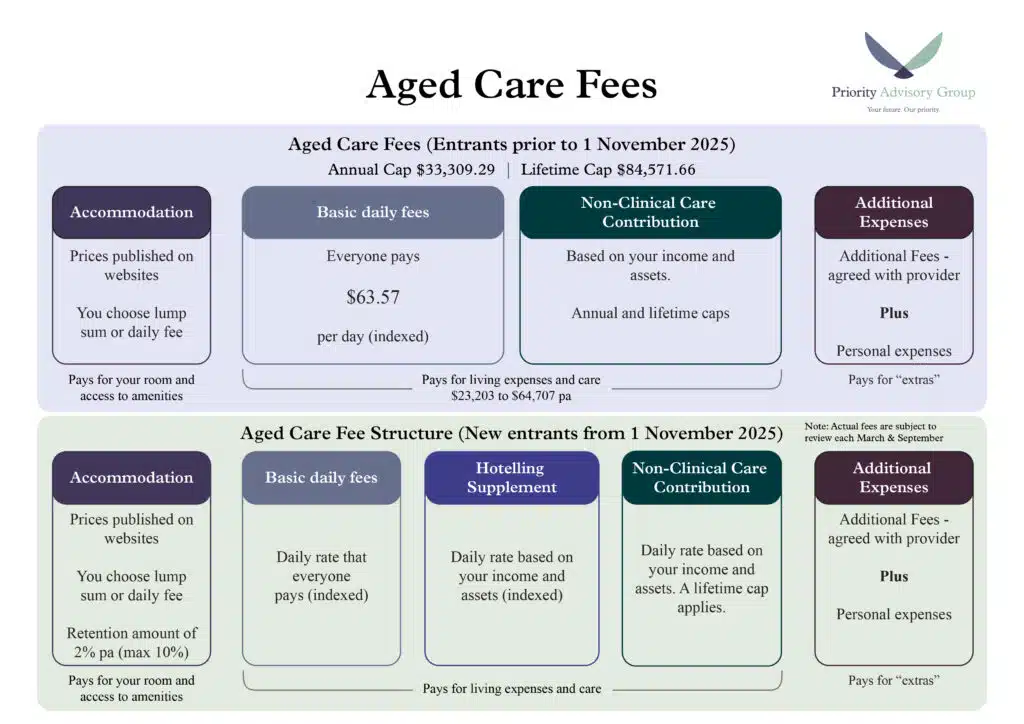

Below is an overview of the difference in aged care fee structures pre-and post-reforms that came into effect in November 2025.

Aged Care Fees + Why Advice Matters

Even under the reformed system, two people entering aged care at the same time can face very different costs. Asset structure, timing, whether a partner remains in the home, how accommodation is funded, and whether advice is sought all play a role.

Common mistakes include selling the family home too early, committing to a full RAD without understanding retention impacts, misunderstanding how everyday living contributions apply, or relying solely on information provided by aged care facilities. While providers explain their fees, they do not provide personal financial advice.

Specialist aged care advice helps families understand how the new rules apply to their situation, manage cash flow, preserve Age Pension entitlements where possible, and minimise unintended estate impacts.

Aged care advice is not just about reducing fees. It is about protecting

dignity, independence, and family outcomes at a time when clarity matters most.

Clarity Brings Confidence

Aged care fees can be complex, but they are not unmanageable. By learning how the different costs work together, you place yourself in a stronger position to protect both quality of care and financial wellbeing. When families approach aged care with clarity, they gain confidence, making each step forward easier.

If you or a loved one is reaching a stage where aged care decisions need to be made, Priority Advisory Group’s Aged Care Financial Advice team can help you understand your options, reduce uncertainty, and protect your family’s financial future. Speak with a specialist today on 1300 349 188 or visit our website to arrange a confidential conversation.

Further Reading

Below you’ll find links to content concerning a number of important aged care considerations:

- Choosing to Stay in Your Home

- Planning for Aged Care

- The Value of Advice – Working with Your Adviser

- Aged Care: What are Your Choices?

- RADs Explained

- The Cost of Residential Aged Care

Please note the information provided within this article is general of nature and is not a personal advice recommendation. Prior to considering strategies discussed in this article we recommend you seek personal financial advice. Please be aware that, without the benefit of financial advice, you may be committing yourself to financial strategies or products that are not appropriate for your overall personal situation, needs and objectives.