When you picture retirement, do you see lazy beach mornings, grey-nomad road trips, or simply more time with the grandkids? Whatever that vision, it’s powered by one thing: reliable income. Yet ask ten Australians how much they’ll need each year in retirement, and you’ll probably hear ten very different figures. The gap between expectation and reality can be dangerous—over-estimating can spark unnecessary anxiety, while under-estimating may leave you short when work stops. Pinning down the cost of retirement is step-one in any sound plan, so let’s unpack the latest benchmarks, bust some myths about “magic numbers”, and show how you can shape a strategy that funds a life you’ll love long after the payslips end.

ASFA’s Benchmarks – Comfortable vs Modest

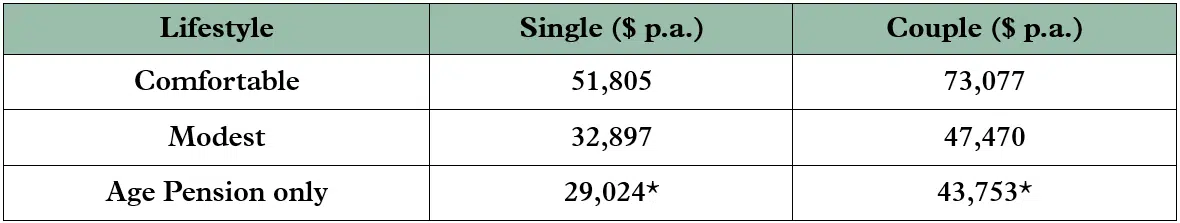

The Association of Superannuation Funds of Australia (ASFA) updates its Retirement Standard each quarter to reflect real-world spending by retirees. For the December 2024 quarter, ASFA estimates a comfortable lifestyle costs $51,805 a year for a single and $73,077 for a couple, assuming you own your home and enjoy reasonable health. A modest lifestyle—which still covers the basics but leaves little room for extras—comes in at $32,897 and $47,470 respectively.

What “Comfortable” Really Buys

ASFA’s comfortable budget covers four pillars: daily essentials (housing, groceries, transport), health & fitness (private cover, doctor visits, exercise classes), social engagement (streaming, club memberships, cinema), and staying connected (laptop, internet, interstate travel yearly and one overseas trip every seven years). Of course, comfort is subjective—if you crave annual European cruises or want to bankroll grandkids’ school fees, your number will be higher. The key is using these figures as a baseline, then customising for the lifestyle you value.

A Retirement Reality Check

While ASFA pegs “comfort” at about $52-73 k, working-age Australians dream bigger: Vanguard’s How Australia Retires survey found they want a whopping $99,000 p.a. in retirement income. By contrast, current retirees are content with roughly $68,000. Why the mismatch? Younger workers struggle to imagine lower day-to-day costs and often factor in rising rents, late-life travel fantasies, or simply anchor to their pre-retirement salary. As retirement approaches, reality bites: paid-off mortgages, fewer dependants, and reduced work-related costs all pull actual spending down. The lesson? Anchor expectations to evidence, not headlines—or you risk chasing an unnecessary (and demotivating) target.

Step-by-Step: Estimating Your Own Retirement Income Needs

- Visualise your lifestyle.List the non-negotiables (e.g. private health, caravan trips, art classes).

- Audit current spending. Strip out work-related costs (commuting, professional attire) and mortgage payments if you’ll be debt-free.

- Apply a rule of thumb. Two-thirds of your present living costs is a starting point, but adjust for travel dreams, health, or caring responsibilities.

- Stress-test with ASFA. Compare your estimate to ASFA’s comfortable and modest budgets—are you in the ballpark?

- Model inflation. Even at 2.5 % p.a., today’s $73 k couple budget could top $95 k within a decade, while longevity and healthcare creep into the equation.

Many clients discover their “magic number” is lower than feared once they separate wants from needs and allow for future mortgage clearance. Conversely, those planning early retirement or extensive travel often see their target rise. Your adviser’s modelling software can run scenarios in minutes—saving countless spreadsheets and sleepless nights.

Stacking Your Income Streams

Superannuation usually sits centre-stage, but it rarely performs solo. Think of retirement funding as a quartet:

- Superannuation. Grow it via salary sacrifice, personal concessional contributions, or after-tax (non-concessional) boosts. A balance around $595 k (single) / $690 k (couple) at age 67 should cover ASFA’s comfortable target when combined with part Age Pension.

- Age Pension. Many retirees qualify for at least a part payment. The income and assets tests change regularly, so review eligibility each year.

- Other investments. Rental property income, share dividends, managed funds, or even a side hustle can diversify cashflow and cushion market swings.

- Work in transition. A Transition-to-Retirement (TTR) income stream lets you cut hours, draw a limited pension from super, and keep contributing—softening the leap out of full-time work.

Choosing between lump-sum withdrawals, account-based pensions, or annuities hinges on tax, Centrelink impacts, risk tolerance, and estate goals. Personalised financial advice is essential.

Narrowing the Gap: Practical Strategies

- Maximise super early. The power of compounding means an extra $100 a fortnight salary-sacrificed from age 40 can translate to tens of thousands of extra balance by 67.

- Reduce expensive debt. Every dollar of mortgage or credit-card interest saved is a guaranteed “return”. In many cases, eliminating high-interest debt beats additional super contributions—an adviser will crunch the numbers.

- Invest tax-effectively. Franked Australian shares, low-cost index funds, and (for some) investment bonds can deliver after-tax income streams that complement super.

- Review insurance. Premiums for life and TPD cover often surge in your fifties. Adjust sums insured as debts fall—redirect the savings to wealth-building.

- Plan for aged care. Accommodation deposits, daily fees, and means-tested care payments can erode capital fast. Early planning (and possible home-equity strategies) avoids fire-sale decisions later.

The Value of a Tailored Retirement Plan

Vanguard’s research shows those with a written financial plan feel twice as confident about retirement as those without. Yet podcasts and social media, not advisers, top the list for guidance among working-age Australians. Quality advice does more than pick investments—it stress-tests longevity risk, maps tax efficiencies, and keeps emotions in check when markets wobble. At Priority Advisory Group we believe peace of mind is priceless—and entirely achievable with the right roadmap.

Turn Intention into Action

Whether you need $52 k, $73 k, or somewhere north of $99 k a year, the number itself is only half the story. What matters is having a plan to hit it—one that evolves with your life and keeps pace with inflation, legislation, and dreams that shift over time. Ready to put your retirement on the front foot? Call Priority Advisory Group’s Personal & Family Wealth team today on 1300 349 188 or visit www.priorityag.com.au/contact/ to book a complimentary initial chat.

Please note the information provided within this article is general of nature and is not a personal advice recommendation. Prior to considering strategies discussed in this article we recommend you seek personal financial advice. Please be aware that, without the benefit of financial advice, you may be committing yourself to financial strategies or products that are not appropriate for your overall personal situation, needs and objectives.