In February, delegates from Priority Advisory Group attended the Financial Standard’s Annual Chief Economists Forum in Sydney, where six of Australia’s leading investment professionals shared their views on the global and domestic economy, and the outlook for markets. Inflation in Australia (and around the world) has eased, but remains above targets, while global share markets are mixed. China’s market is at similar levels to what it was in 2016, while the USA and Australia are reaching al-time highs. So that begs the question – what’s on the cards in the coming 12 months?

As always, we’re keen to keep our clients in the loop about the range of factors that impact their investments and finances. Our Head of Workplace Financial Advice (WFA) Gareth Hall has summarised some highlights and key takeaways from the Chief Economists Forum, and what the expert speakers had to say (for those that haven’t met Gareth, you can find out more about him at the end of this article).

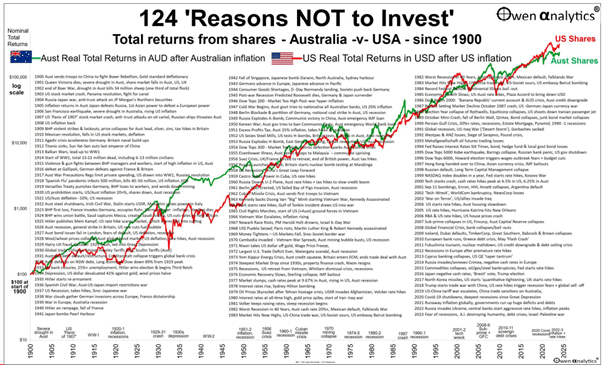

“Reasons NOT to Invest”

Don Stammer, investment market writer and commentator, provided a timely reminder of the fundamentals of investing. Outlined excellently by the graphic below, each of the past 124 years has delivered short-term “reasons not to invest” in Australian and/or US markets. These can include drought, war, famine, the Great Depression, 9/11 attacks, COVID-19, and more. What we know, of course, is that real returns come with a long-term investment perspective. “Zooming out” and looking at the bigger picture shows us that short-term volatility is a natural part of the journey to investment success.

Source – Owen Analytics

Australian Economy Headwinds & Tailwinds in 2024

Also presenting at the Chief Economists Forum was Chris Paton, Chief Investment Officer at Latrobe Financial. Last year he posited that there would be “…cause for optimism that Australia will avoid a recession and see growth in 2024”. Early signs are that Chris’ prediction was very astute indeed. He outlined three headwinds and three tailwinds that could potentially play a big role in the fortunes of our economy this year.

Headwind 1: Geopolitical risks in Europe and the Middle Easy continue. Add to that the fact that around half the world’s population are voting in elections this year and we have the potential for further unrest and the knock-on effect that has on the global economy.

Headwind 2: Inflation will be “stickier” with a higher neutral policy rate, as a result of increased spending – particularly with the cost of emissions reduction and de-carbonisation, and overall Government expenditure.

Headwind 3: Consumer confidence and demand are “plumbing new depths”. Consumer confidence has reached the same lows it did in 1992 during the “recession we had to have”; and retail sales are also back where they were at that stage (excluding the COVID years).

Tailwind 1: Low unemployment combined with high rates of immigration (600,000 in 2023 and 250,000 per annum ongoing), are both positive signs of economic growth.

Tailwind 2: The fact we avoided recession is incredibly significant. This is due in part to our diversification of trade, particularly our efforts to find trading partners to make us less dependent upon China.

Tailwind 3: Productivity may be turning a corner – non-farm GDP per hour (a measure of productivity) has risen sharply since the early stages of 2023, as has business investment.

The property market is set to remain strong due to a low stock of homes for sale, combined with historically low rental vacancy rates and low approvals for new dwellings. Population growth will further increase demand, pushing prices up. Banking and credit seem well positioned for resilience with additional household saving that had accumulated over the COVID period, and relatively low rates of arrears and non-performing loans.

The Economy’s “Narrow Path”

Warren Hogan, Chief Economist at Judo Bank, believes the remains on the ‘narrow path’ in early 2024. Employment is up, however business activity has been below neutral; and with input costs higher, sales have brough about lower profits. Warren feels a risk we face nationally is incorrect monetary policy, predicting a 0.35% interest rate cut in November, and noted that real interest rates have only become positive in the last few months (due to higher inflation last year).

Rising interest rates and a more pro-active ATO were having a big impact on insolvency in 2023, with 30,000 to 60,000 ‘zombie’ companies in the economy – companies that were distressed and could not repay their debt. Labour shortages remain widespread with low vacancy rates.

A Perspective on Global Risks

Representing the Climate Council, Independent Economic Consultant and Councillor Nicki Hutley shared a list of the perceived risks faced, by severity, over 2 and 10 years and how the perception of risks had changed:

2 Years:

- Misinformation and disinformation

- Extreme weather events

- Societal polarisation

- Cyber insecurity

- Interstate armed conflict

- Lack of economic opportunity

- Inflation

- Involuntary migration

- Economic downturn

- Pollution

10 years:

- Extreme weather events

- Critical change to Earth systems

- Biodiversity loss and ecosystem collapse

- Natural resource shortages

- Misinformation and disinformation

- Adverse outcomes of AI technologies

- Involuntary migration

- Cyber insecurity

- Societal polarisation

- Pollution

She also discussed the impact of Artificial Intelligence (AI) – the good being areas like improved medical diagnosis, and the bad being issues such as job losses, deep fakes, security, bias and discrimination, inequality, market volatility, power concentration, and death. She also noted that 30% of the worlds biggest firms had let go 5% of their employees, and a concern was power concentration in the large companies.

How to Navigate Domestic and Global Market Uncertainty as an Investor

This presentation was delivered by Koda Capital’s Brigette Leckie, with a largely positive outlook. She outlined the fact that US GDP was 4% last year and concluded that we’d experience a ‘soft landing’, largely because of full employment in many economies. She felt in the US that a ‘soft landing’ would be the result of 2 or 3 interest rate cuts as inflation eases, while growth and earnings moderate. Like some other presenters, Brigette pointed out that company earnings were good, and that inflation has eased but is still above central bank target rates.

Looking Ahead

The final presenter was at the 2024 Chief Economists Forum Brian Parker, Chief Economist at Australian Retirement Trust. He spoke about his belief that the next 12 to 18 months would be very challenging as we navigate economic pain to reduce inflation, suggesting many economies were already in recession and that real household incomes are declining significantly. Some key insights and observations from Brian are as follows:

- Over the last decade ‘a rising tide lifted all boats’

- There will be more volatility to come, geopolitical issues will be the primary driver, and the problems of the world require ‘grown-ups’ in power to negotiate good outcomes.

- Investors should consider diversifying portfolios and get ready to take advantage of opportunities

- The tech boom may exacerbate political problems.

- He anticipates an inflationary world over the next 20 years.

- His “X Factors” are US Tech, property, China stocks and that the Israel war may result in a more sedate middle east.

Overall, there was a lot to take away from the Chief Economists Forum. Different insights and backgrounds lead, naturally, to different conclusions and predictions about where the economy and investment markets are headed. What we can say for sure, however, is that the best monetary decisions are made when you partner with a trusted financial adviser. The Personal & Family Wealth team at Priority are here to help you understand your tolerance for risk, build a portfolio to suit your needs and goals, and ensure that your overall financial plan remains on track while global political and economic forces play their part. If you’re yet to reach out to us, please do so on 1300 349 188, or contact us via our website.

Gareth began his career in financial services in 1990 following a major health crisis that led to a profound change in his personal and professional goals. A desire to assist families to avoid the heartache of financial loss motivated this career change, from mechanical engineering into financial planning and advice, and Gareth and his wife Carmel founded Lifestyle Financial Services in 1994. He then guided Lifestyle through nearly thirty years of growth into a premier holistic financial planning and corporate superannuation services firm, and remains a key figure since Lifestyle’s merger with Priority Advisory Group.

Gareth is a founding member and former Treasurer of the Workplace Super Specialists Australia (WSSA), an association that represents advisory businesses that specialise in corporate superannuation, and has been involved with all the WSSA activities since its formation in 2009. Gareth enjoys bicycle touring (particularly on country roads), travel, most things to do with cars and motorcycles, great food and good wine.